Published by Vedwire

China has announced retaliatory tariffs of up to 84% on US goods, effective April 10, 2025, in response to the US hiking tariffs on Chinese imports to 104%. This bold move intensifies the trade war between the world’s two largest economies, sending shockwaves through global markets. In this detailed news analysis from Vedwire, we break down the tariffs, their history, and what they mean for businesses and consumers—all in simple, easy-to-understand terms.

Understanding China’s Retaliatory Tariffs

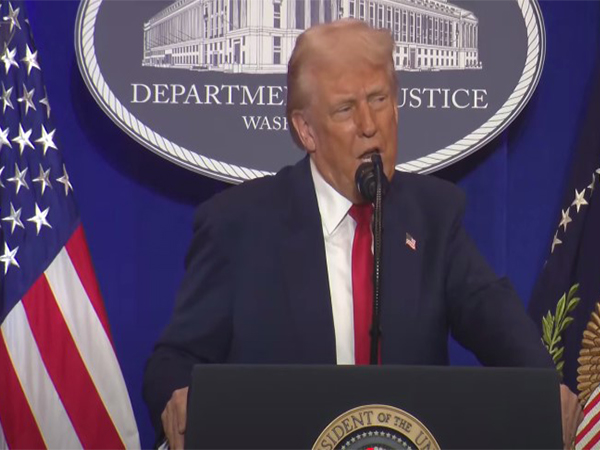

China’s retaliatory tariffs target a wide range of US products, from soybeans to electronics, as a counterpunch to the US imposing steep duties on Chinese imports. The US tariffs, led by President Trump, aim to address what he calls “unfair trade practices,” but China sees them as an attack on its economy. Starting April 10, 2025, these 84% tariffs will make US goods far more expensive in China, escalating tensions further.

A Quick Look at Recent Trade War History

The US-China trade war has been brewing for months. Here’s a simple timeline:

- April 03,2025: Trump slapped a 34% tariff on Chinese goods, accusing China of trade imbalances.

- Shortly After: China hit back with matching 34% tariffs on US products.

- April 10,2025: Trump upped the stakes, adding a 50% duty, bringing the total US tariff on Chinese imports to 104%.

- April 10, 2025: China responds with its 84% retaliatory tariffs on all US goods.

The European Union has also jumped in, imposing 25% tariffs on US goods, complicating the global trade landscape even more.

Tariff Breakdown: Who’s Charging What?

Here’s a clear table comparing the latest tariffs:

| Country | Tariff on Imports | Effective Date |

| US | 104% on Chinese goods | April 09,2025 |

| China | 84% on US goods | April 10, 2025 |

| EU | 25% on US goods | April 10,2025 |

The US leads with the highest tariffs, but China’s 84% response is a close second, dwarfing the EU’s more modest 25%.

How China’s Retaliatory Tariffs Hit Global Markets

These tariffs are rattling the world economy. Stock markets are swinging wildly as investors fear a recession. The Bank of England has warned that Trump’s tariffs could trigger “severe shocks” to global growth. Oil prices have already dipped, with Brent crude falling to $60.46 per barrel, reflecting market jitters.

Also Read:https://vedwire.com/india-ends-bangladesh-trans-shipment-export-route-closed/

Businesses are feeling the heat too. Companies like Delta Air Lines have scrapped their 2025 forecasts due to trade disruptions, while manufacturers scramble to rethink supply chains.

What This Means for You

For everyday people, China’s retaliatory tariffs mean higher prices. In the US, expect costlier Chinese-made goods like phones and clothes. In China, US products like cars and soybeans will take a price hit. Businesses face tough choices—raise prices, eat the losses, or move production elsewhere, which isn’t cheap or quick.

Voices from the Frontlines

President Trump calls this a win, tweeting it’s a “great time to move your company” to the US. But not everyone agrees. The American Chamber of Commerce in China warns the tariffs will “do more harm than good,” hurting businesses on both sides.

The Bottom Line

China’s retaliatory tariffs signal a new, chaotic chapter in the US-China trade war. With global markets on edge and prices set to rise, the fallout will touch everyone—from Wall Street to Main Street. Stay tuned to Vedwire for the latest updates.

- Trump takes U-turn on running for presidency in 2028, backs JD Vance, Rubio: Here’s what he said

- RBI keeps repo rate unchanged at 5.5% amid Trump tariff threat

- Shocking Claim: Zelensky claims Chinese Fighters in Russia’s Ukraine War

- Triumphant: Royal Anniversary Vatican Visit Amid Italian State Trip

- Trump Slaps 125% Tariffs on China, Offers 90-Day Tariff Pause for Negotiating Nations

Leave a Reply